Wake County Property Taxes: A Comprehensive Exploration

Thesis Statement

Wake County's property tax system is a complex and multifaceted issue, with various perspectives, implications, and room for potential improvements. To navigate its complexities effectively, property owners must understand the system's key components, including assessments, exemptions, rates, and the tax cycle.

Understanding the Assessment Process

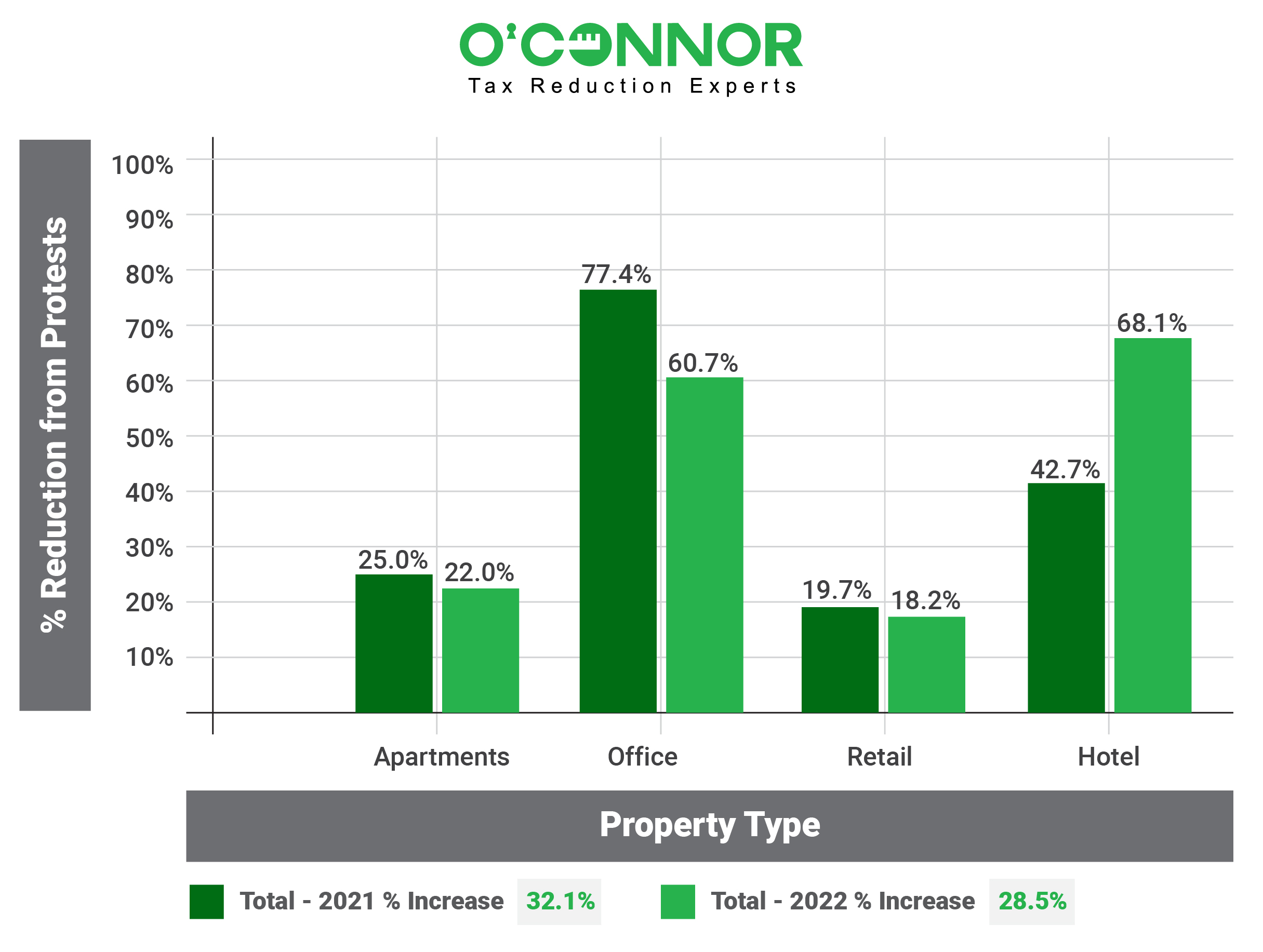

The assessment process is not without its challenges. Property owners may dispute their assessments if they believe they are inaccurate or unfair. The protest process allows property owners to present evidence to support their claims for a reassessment. However, it is important to note that successful protests can result in either an increase or a decrease in the property's taxable value.

Exemptions and Deductions

Wake County offers various exemptions and deductions to reduce the tax burden on certain property owners. Tax exemptions are complete or partial exclusions from property taxes, while deductions reduce the taxable value of a property.

Qualifying exemptions include homestead exemptions for primary residences and exemptions for religious, educational, and charitable organizations. Income-based deductions are also available for low-income property owners and disabled veterans.

Property Tax Rates

Once a property's taxable value is determined, it is multiplied by the tax rate to calculate the property tax bill. Wake County's property tax rate consists of a base rate set by the county and a supplemental rate set by each municipality within the county.

The tax rate varies depending on the location and the services provided by the local government. For example, areas with higher levels of infrastructure investment and public services tend to have higher supplemental tax rates.

The Tax Cycle

Understanding the property tax cycle is essential for timely payments and avoiding penalties. The tax cycle typically follows a schedule that includes the following steps:

Penalties for late payments or non-payment of property taxes can be substantial. Property owners should make every effort to pay their taxes on time to avoid additional costs.

The complexities of Wake County's property tax system have given rise to various perspectives and debates. Some perspectives argue for lower property taxes to reduce the tax burden on homeowners. Others advocate for higher property taxes to fund essential public services.

Proponents of lower property taxes contend that high taxes can hinder homeownership, particularly for low-income families, and negatively impact the local economy by discouraging investment and development. However, opponents of lower property taxes argue that they would compromise the quality of public services and infrastructure, which ultimately harms the entire community.

Engaging with Scholarly Research and News Articles

Scholarly research provides valuable insights into the impact of property taxes on various aspects of society. A study by the Lincoln Institute of Land Policy found that high property taxes can lead to reduced homeownership rates, especially among low-income families. Another study by the Center on Budget and Policy Priorities showed that property taxes can contribute to income inequality, as higher-income households tend to own more valuable properties and pay a larger share of property taxes.

News articles have also highlighted the challenges and controversies surrounding Wake County's property tax system. A 2023 article in The News & Observer reported on the county's efforts to address concerns about rising property values and the impact on homeowners. The article discussed proposals for tax relief measures, such as expanding the homestead exemption and increasing income-based deductions.

Recommendations for Improvement

Conclusion

Wake County's property tax system is a complex and multifaceted issue with significant implications for property owners and the community. Understanding the key components of the system, including assessments, exemptions, rates, and the tax cycle, is essential for navigating its complexities effectively.

The complexities of Wake County's property tax system require ongoing scrutiny and dialogue to ensure its fairness, transparency, and alignment with the county's fiscal and social priorities. By embracing a collaborative approach and fostering a better understanding of the system, we can create a more just and balanced property tax landscape for all.

This Wednesday Morning Meme Will RUIN Your Day (In A Good Way!)

Data Disaster! How To Prevent & Recover From Unauthorized Rollbacks

Client.connected Delays Killing Your App? This Fixes It!